Let’s face it—talking about money with your partner isn’t exactly romantic. But it is essential. From surprise bills to clashing spending habits, most relationship stress around money stems from a lack of regular, honest conversations.

Fortunately, there is good news! You don’t need to talk about your budget every night over dinner. But you do need a rhythm—something intentional, consistent, and clear.

So how often should couples talk about money? Personal finance expert Catherine Alford suggests that discussing money once a month is the ideal frequency. Here’s why that works—and how to make it a conversation you’ll actually want to have.

Why You Shouldn’t Avoid Money Talks

We all know the temptation: “Let’s just deal with it later.” But when it comes to money, delaying the conversation can mean missed goals, hidden debt, and sudden stress when those big bills roll in.

Money isn’t just numbers—it’s tied to your dreams, fears, habits, and priorities. And in a relationship, those things need to be shared.

Quick stat: According to a 2023 report by Fidelity, couples who talk about money at least once a month report higher satisfaction in both their finances and their relationship.

Schedule Monthly ‘Money Dates’

Alford recommends a monthly money meeting—ideally at the start of each month. Why?

Because that’s when you can:

- Review last month’s spending

- Prepare for upcoming bills and events (think birthdays, travel, annual fees)

- Adjust budgets based on what’s coming up

You might also consider a mini mid-month check-in (around the 15th) to see how the plan is holding up and make tweaks if unexpected expenses pop up.

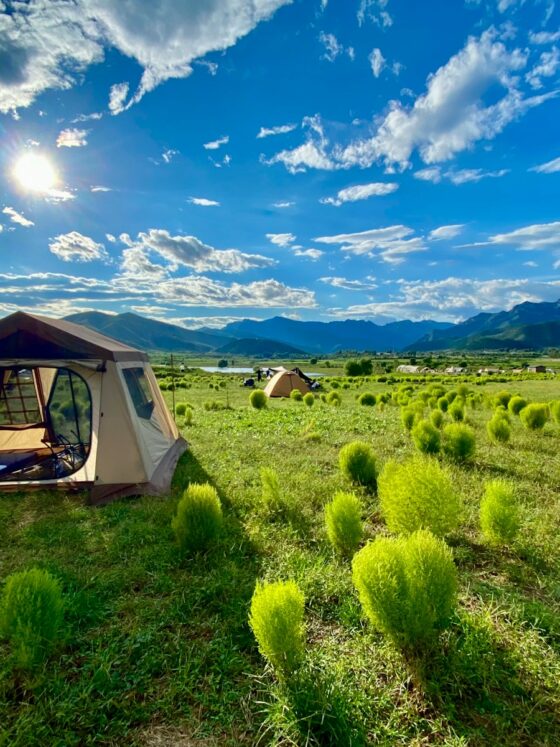

Tip: Make it a standing event. Same day, same time each month. Add snacks or wine to make it feel less like a chore.

What to Cover in Your Monthly Money Talk

Without a structure, a money chat can quickly spiral—or fizzle out. Use a simple agenda to stay on track:

- Start with your “why” – dream out loud. Are you saving for a home? A dog? Early retirement? Starting with your shared goals sets the tone.

- Review last month – Look at income, spending, bills paid, and where you overspent (or saved!).

- Plan for the new month – What’s coming up? Any major expenses? Adjust your budget accordingly.

- Talk debt and credit – Check in on credit card balances, loan payments, or any upcoming due dates.

- Investments + long-term planning – Peek at retirement accounts, stock performance, or savings goals.

- Assign tasks – Who’s paying what? Are any accounts due for review or renewal?

Bonus: Keep a shared spreadsheet or money journal so you both stay on the same page—even between meetings.

Who Leads the Conversation?

If one of you loves spreadsheets and the other runs from receipts, find a balance. One partner can lead the meeting while the other keeps notes and follows up on action items. Or take turns month-to-month.

The key is shared responsibility, not one person always doing the heavy lifting.

Who Leads the Conversation?

If one of you loves spreadsheets and the other runs from receipts, find a balance. One partner can lead the meeting while the other keeps notes and follows up on action items. Or take turns month-to-month.

The key is shared responsibility, not one person always doing the heavy lifting.

Make It a Habit (Not a Hassle)

These meetings don’t need to be stiff or stressful. In fact, Catherine Alford suggests you start each money date with a reminder of your “big, audacious goals.”

Whether it’s that beach honeymoon, buying your dream car, or becoming debt-free—keep your eyes on the prize.

Why not make it fun? Budget night = pizza night. Or have your chat while walking, journaling, or even sitting in your favourite café.

The Bottom Line: Talk About Money Before It Becomes a Problem

Money touches everything in a relationship—from the way you spend weekends to how you build your future. And ignoring it doesn’t make it go away.

Instead of bottling things up, schedule monthly check-ins, build transparency, and set shared goals. When you approach money as a team, you’re not just avoiding financial stress—you’re building trust and connection.

Related Reads on Our Site:

- How to Split Finances Without Fighting

- Joint Accounts vs Separate: What’s Best for Couples?

- Budgeting for Big Life Goals (Without Losing the Plot)

Final Thought:

Talking about money isn’t awkward—it’s powerful. One monthly chat could transform your financial future and strengthen your relationship. So mark the calendar, bring your goals, and start the conversation.